florida estate tax exemption 2020

Estate Tax Exemption for 2021. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it.

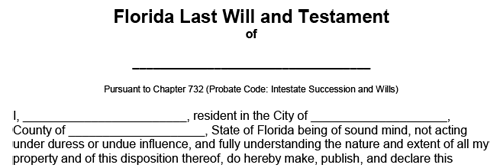

Will My Florida Estate Be Taxed

The mortgage insurance premium property tax exemption is a federal exemption that was eliminated for tax year 2018 but is available once again in 2019 and will be in 2020 as well.

. It lets homeowners deduct mortgage insurance payments they made during the tax year. Still individuals living in Florida are subject to the Federal gift tax rules. The top marginal rate remains 40 percent.

How Does the Lifetime Gift and Estate Tax Exemption Work. Mortgage Insurance Premium Property Tax Exemption. However if the current federal tax laws remain in place the exemption amount will be decreased by 50 in 2026.

Generally a person dying between Jan. This may sound complicated but the end result is actually quite simple. A person may be eligible for this exemption if he or she meets the following requirements.

The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within 9 months after the date of death unless an extension of time to file was granted. 11292020 Federal Estate Gift and GST Tax. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. Amendment 3 provided property tax exemptions to first responders who have been. The estate and gift tax exemption is 1158 million per.

For instance if you give away an asset worth 205000 180000 over the yearly maximum your eventual estate tax exemption will be reduced from 1118 million to 11 million. Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and Form DR-501SC see section 1960752 Florida Statutes. The estate tax exemption in 2021 is 11700000.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption. Florida estate tax exemption 2020. If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes.

What this means is that estates worth less than 117 million wont pay any federal estate taxes at all. Amendments to Floridas homestead tax exemptions. Form 4768 Application for Extension of Time to File a Return andor Pay US.

At the time of this writing in 2020 based on the Unified Credit each US. The estate tax exemption for 2020 is 1158 million per decedent up from 114 million in 2019. The section has been amended 12 times since 1980.

Homestead Exemptions are available on primary residences in Florida. That number is used to calculate the size of the credit against estate tax. Section 6 of Article VII of the Florida Constitution details homestead tax exemptions.

The estate tax exemption for 2020 is 1158 million per decedent up from 114 million in 2019. Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. Once you use it up you cant get it back so its a good idea to gift strategically.

Estate tax is calculated on all of your assets when you die and theres a nonrefundable credit equal to the tax that would be charged on the lifetime exemption 4577800 in 2020. Citizen could die with an estate up to 11580000 and there would be no Federal estate tax due. Sticky Post By On 24.

Any assets left to your heirs will be taxed at a 0 rate up to 1158 million and at a 40 rate beyond. View Federal Estate Gift and GST Tax Exemptions Update 2020pdf from TAX 6726 at University of Florida. While Florida imposes neither an.

Florida used to have a gift tax but it was repealed in 2004. For example if someone who dies in florida owns valuable property in another state. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. The lifetime gift exemption is just that a lifetime maximum.

For married couples that amount is doubled since each spouse is entitled to the exemption and each spouses exemption is portable to the last spouse to die. So feel free to transfer gifts valued in this amount to any number of individuals each without worrying about taxes. There is no gift tax in Florida.

The lifetime gift tax exemption for gifts made during 2020 is 11580000 increased from 114 million in 2019. The most recent changesAmendment 3 and Amendment 5were approved in 2016. 2020 estate tax exemption november 19 2019 posted by rla estate.

Remember the annual gift tax exclusion for 2021 stands at 15000 and 16000 in 2022. But if you go above that threshold for a particular person you begin to reduce your lifetime gift and. With the estate tax level so high which doubles to 2412 million for a married couple very few peopleestates need to worry about the federal estate tax.

A florida resident who dies may still owe an estate tax for property located in other states. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries.

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Eight Things You Need To Know About The Death Tax Before You Die

Estate Tax Landscape For 2021 And Beyond

Inheritance Tax In Florida The Finity Law Firm

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Estate Planning For Non Citizens Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate Planning Guide Everything You Need To Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Homestead Exemption In Florida Doane Doane P A

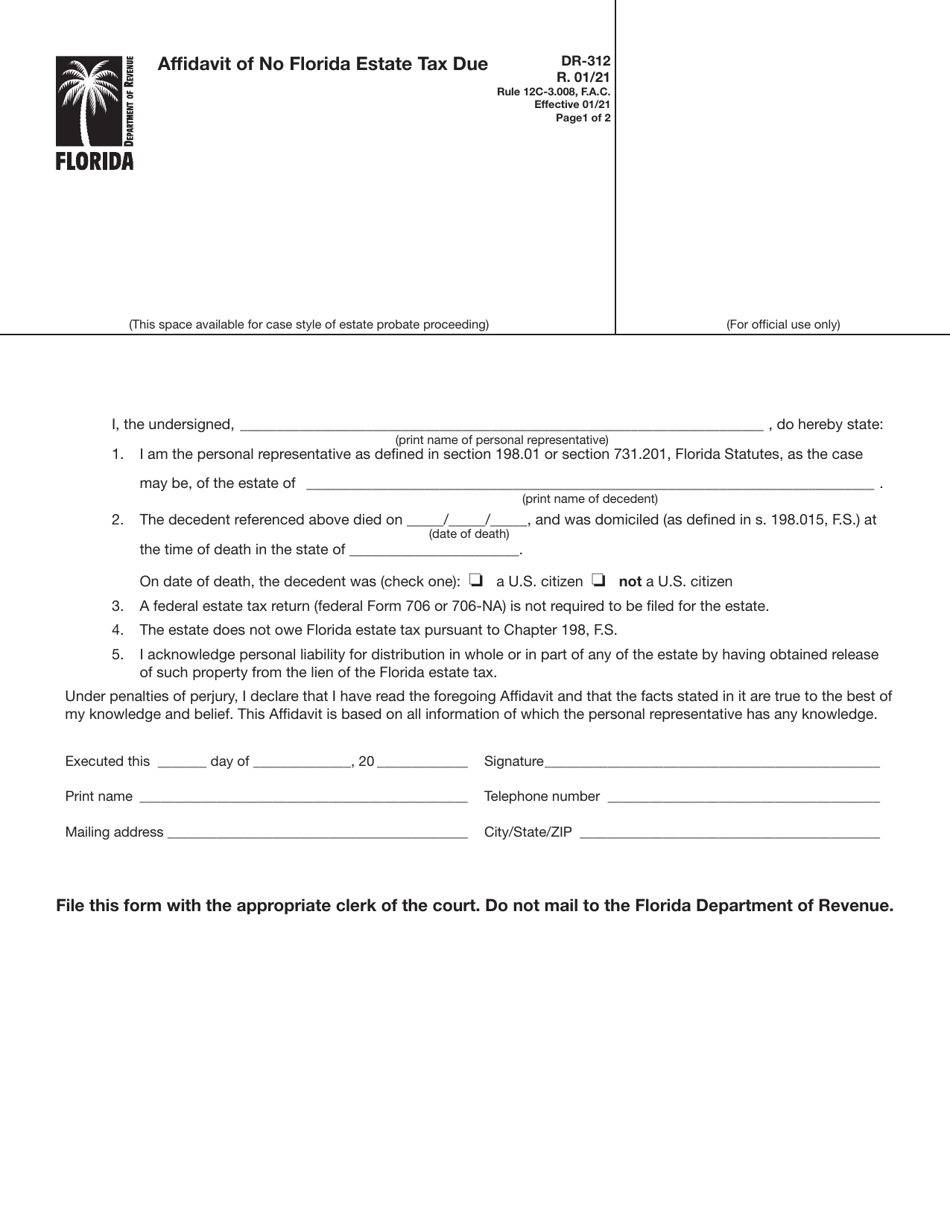

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Inheritance Tax Beginner S Guide Alper Law

Recent Changes To Estate Tax Law What S New For 2019

Florida Property Tax H R Block

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller